Believing in Bigfoot

1—Believing in Bigfoot

What makes a good leader? Given Sam Bankman-Fried's fall from grace and Elizabeth Holmes' prison sentence, we went back to an interview between David Epstein and Dan Coyle in which they discussed the latter's book The Culture Playbook: 60 Highly Effective Actions to Help Your Group Succeed:

"Some may ask: What about brilliant-jerk leaders like Steve Jobs, Elon Musk, Michael Jordan, and Thomas Edison? The answer is that brilliant jerks are indeed effective in rare cases, such as when they lead a group that holds a strategic advantage over the rest of the market. For the vast majority of groups, it works less well, because their people will simply leave for a competitor rather than endure jerk behaviour. Even Steve Jobs stopped being a jerk when he realized how much it hurt the group."

According to Coyle, "the heroic-genius model of leadership is outdated":

"The world today is so complex and fast-changing. Believing that a single human can be massively smarter and hungrier and more creative than everyone else is sort of like believing in Bigfoot. Accordingly, most of the great groups I've studied aren't led by heroic geniuses, but rather by teams of humble leaders who collaborate, listen, and, above all, learn from their mistakes."

You can read the full exchange here (~14 minute read), during which Coyle warns that "as a society we absolutely LOVE the heroic-genius story", leading many people to buy into the stream of BS that came from the likes of Elizabeth Holmes and Sam Bankman-Fried.

2—Who, What, When, Where, Why

The folks at CoinMetrics and Chainalysis posted their findings on the FTX debacle, with the former digging into how Alameda managed to lose billions of FTX user funds, while the latter focused on the aftermath – how does the FTX collapse compare to Mt. Gox's demise in February 2014?

According to CoinMetrics, Alameda – the hedge fund with an "immensely blurred" connection to FTX – may have been insolvent as early as the fourth quarter of 2021, leading it to tap into FTX user funds which were subsequently obliterated by the combination of:

📉Directionally wrong trades, likely leveraged

📉DeFi lending markets, esp. stablecoin-denominated

📉Cross-chain bridges, either hacked or their native tokens becoming worthless

Alameda was trying to trade its way out of a multi-billion dollar hole right until the bitter end, "borrowing 1,000,000 USDT on Aave at a 52.9% interest rate" on 10 November, the day before FTX collapsed.

But is the collapse of FTX the end of crypto? Chainalysis notes that crypto has faced worse crises in the past:

"Mt. Gox was ultimately a bigger part of the crypto ecosystem overall when it collapsed than FTX was. Mt. Gox accounted for 10.9% of total service inflows in the 12 months before its collapse, vs 4.7% for FTX.

In other words, Mt. Gox was a linchpin of the CEX category at a time when CEXes dominated. But as we all know, crypto survived Mt. Gox's collapse and continued to grow and thrive."

The Mt Gox collapse saw transaction volume stagnate for a year before recovering, which Chainalysis says "should give the industry optimism".

Time will tell. You can read the CoinMetrics report here (~7 minute read) and the Chainalysis report here (~4 minute read).

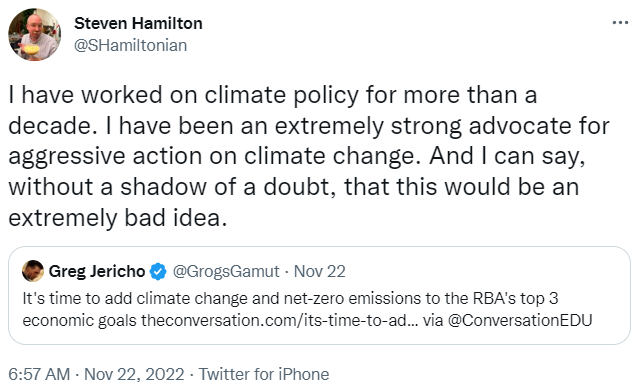

3—An extremely bad idea

4—The rise of the second Sweden

"For the past three decades, Sweden has confused foreigners with its combination of a large welfare state and neoliberal policies such as abolishing the inheritance tax and applying market principles to the state. When Bernie Sanders, the American left's presidential candidate, cited Sweden as an ideal of 'democratic socialism,' he was not likely thinking of universal school vouchers and private pensions. Now Sweden is set to confuse observers again with a new combination of a globalised economy and restrictive policies toward immigration."

That's from Bloomberg's Adrian Wooldridge, who provides a summary of the Sweden we all know – a cosmopolitanism society that is "remarkably pro-business... [and] specialises in turning the adventurous spirit of the Vikings to commercial ends" – but that is having to change tack due to "the disappearance of the old Sweden of social cohesion and low crime, the fraying of the welfare state, with hospital waiting times among the worst in Europe, and the decline of educational standards across the board". According to Wooldridge:

"Sweden was never able to match its generous policy toward migrants with its ability to absorb them into society. Successive waves of refugees, hailing from Bosnia, the Middle East and Somalia, have been trapped in housing developments on the peripheries of big cities such as Stockholm, Gothenburg, Upsala and Malmo. The combination of geographical isolation with low skills in a high-wage economy (with minimum wages negotiated at two-thirds of the median wage) proved toxic. Parallel societies based on clan and religious ties developed. Young people were recruited by criminal gangs. Drug-related crime and violence exploded.

...

Unemployment among the foreign-born is more than three times what it is for native-born Swedes. It takes about eight years for half the new arrivals to start working even part time. High immigration has imposed net costs on the wider society. The Central Bank calculates that the 2015 immigration shock, when Sweden took in the equivalent of 1% of the population, led to a reduction in GDP per capita of 1.7% and an increase in aggregate unemployment of 2.2%."

You can read Wooldridge's full essay here (~7 minute read), which advises Sweden's politicians that:

"The aim of policy must be to preserve what is best about cosmopolitan Sweden while at the same time understanding why it generated such a powerful backlash... [because if you] ignore something that worries the mass of the population in a fit of moral superiority, it will simply be exploited by radical parties."

5—Further reading...

🙊 The governor of the Reserve Bank of New Zealand claimed "inflation is nobody's friend", a bold-faced lie countered by "the thousands of articles about the winners and losers from high inflation".

🤖 "Amazon Alexa is a 'colossal failure', on pace to lose $10 billion this year."

🌍 Artificial intelligence achieved "human-level performance in Diplomacy, a strategy game involving both cooperation and competition that emphasizes natural language negotiation and tactical coordination between seven players".

😷 "China's COVID-19 cases are surging toward record highs, signalling more pain for the world's second-largest economy as hopes fade for a quick exit from Beijing's draconian 'zero-COVID' policies."