Immaculate disinflation

1—Immaculate disinflation

Is the bond market, which is currently pricing in rate cuts towards the end of 2023, forecasting a US recession? Not exactly:

"- Most of the confusion stems from an overly simplistic approach.

- In the average recession over the last 30 years, the Fed cut by 350 bps over an 18 months period.

- The bond market is pricing 200 bps worth of cuts between Jun-2023 and Dec-2024, so that must mean the bond market's base case (60%) is a recession."

According to Alfonso Peccatiello, that simplistic approach is misleading because it ignores "the ultimate landing point for Fed Funds and real yields; the credit market; and the tails":

"Fed Funds are priced to peak at ~5% in summer, and then 200 bps of cuts are expected. Yet, Fed Funds are never (!) priced to be below reasonable estimates of neutral rate (2.25-2.75% in nominal terms) throughout the next 2-5 years.

This would be the first time ever the US is in a recession and the Fed doesn't cut rates below neutral - it doesn't make sense, right?

Indeed, because the bond market's base case is not a recession: it's immaculate disinflation."

You can read Peccatiello's full analysis here (~5 minute read), which concludes that the probability of a US recession is more like 15-25%, not the 60% claimed by some bond market watchers.

2—Shifty shades of grey

How is Russia coping with the West's sanctions? Rather well, as it turns out:

"Russia's exports took a knock after Europe's initial salvo in December. Two months on, however, they have recovered to levels last seen in June. The volume of oil on water, which tends to climb when the market jams up, is back to normal. As expected, China and India are picking up most of the embargoed barrels. Yet there is a surprise: the volume of cargo with unknown destinations has jumped. Russian oil, once easy to track, is now being distributed through more shadowy channels."

That's from The Economist, which delved into the shadowy grey trade and found that it still has "plenty of room to grow":

"For Russia, an expansion of the grey trade has advantages. It puts more of its export machine outside of the control of Western intermediaries. And it makes pricing less transparent. Western estimates of Urals prices, based on few actual trades, are struggling to track costs. Indian customs data from November—the latest available—show the country bought oil at much lower discounts than those reported at the time, notes a former Russian oil executive. Grey-market intermediaries, which capture costs such as freight, offer a conduit for funnelling money to offshore company accounts that the Kremlin can probably influence."

You can read the full article here (~8 minute read), which notes that one side effect of the West's sanctions and growing grey trade is that it will "further split the oil trade along sharp geopolitical lines", and the growing number of ageing ships run by firms with no reputation increases the likelihood of a potentially catastrophic accident.

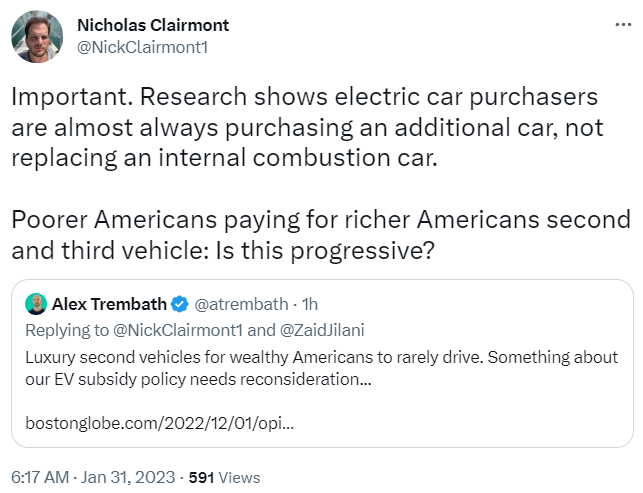

3—Electric vehicle subsidies

4—The mouse that roared

There is a vocal, influential minority led by the likes of Olivier Blanchard that are calling for central banks to target a higher rate of annual inflation than the current standard of ~1-3%.

It's an important topic down under, too, with the results of the review into Reserve Bank of Australia (RBA) to be released this year. There's a reasonable chance that the reviewers are a) foolish enough to suggest raising the target; and b) that Treasurer Chalmers goes along with it.

But before condemning us to repeat the errors of the 1970s/80s, it's worth remembering the lessons from the "mouse that roared" – New Zealand:

"More than 30 years ago, some relatively youthful central bank and Treasury economists in New Zealand were grappling with how to bring two decades of double-digit inflation under control in an economy less than 1% the size of its U.S. counterpart.

What if, they asked, they just told everyone the rate should be much lower - say roughly 2% - and then aim for that?

'It was a bit of a shock to everyone, I think,' said Roger Douglas, the Labour Party finance minister at the time who worked with the Treasury and Reserve Bank of New Zealand (RBNZ) to pioneer the policy. 'I just announced it was gonna be 2%, and it sort of stuck.'

...

When New Zealand became the first country to mandate inflation targeting, the upper limit was 2% and the lower one just 0%. At the time, inflation was running at 7.6% but had tracked above 10% on average between 1970 and 1990, and few people thought the target was realistic."

That's from Lucy Craymer (~4 minute read), who quotes several people involved in the process, including "Arthur Grimes, a former chief economist and senior official at the RBNZ who was seen as one of the key architects of the policy":

"Zero's the obvious sort of place to head for - it is basically saying, on average, prices in 10 years time should be roughly the same as prices now. Why would you want anything different?"

We tend to agree. Inflation is effectively taxation without representation; the lower the better!

5—Further reading...

📉 "Almost 18% of the UK's listed companies issued a profit warning — a similar proportion as during the global financial crisis in 2008."

💩 "FTX founder Sam Bankman-Fried attempted to stall bankruptcy proceedings in the U.S. in November in order to transfer assets from his crypto exchange to foreign regulators, the Justice Department alleged in a filing Monday."

🙈 It'll be trained on Xi Jinping thought: "Baidu is planning to roll out an artificial intelligence chatbot service similar to OpenAI's ChatGPT, according to a person familiar with the matter, potentially China's most prominent entry in a race touched off by the tech phenomenon."

🏡 "We show that the Great Resignation among older workers can be fully explained by increases in housing wealth."