The end of magical thinking

1—The end of magical thinking

Dogecoin, 'Buy Now, Pay Later', meme stocks. All junk, and all with one thing in common – that they were "a manifestation of a magical thinking":

"For these purposes, magical thinking is the assumption that favored conditions will continue on forever without regard for history. It is the minimizing of constraints and trade-offs in favor of techno-utopianism and the exclusive emphasis on positive outcomes and novelty. It is the conflation of virtue with commerce.

Where did this ideology come from? An exceptional period of low interest rates and excess liquidity provided the fertile soil for fantastical dreams to flourish. Pervasive consumer-facing technology allowed individuals to believe that the latest platform company or arrogant tech entrepreneur could change everything. Anger after the 2008 global financial crisis created a receptivity to radical economic solutions, and disappointment with traditional politics displaced social ambitions onto the world of commerce. The hothouse of Covid's peaks turbocharged all these impulses as we sat bored in front of screens, fuelled by seemingly free money."

That's from Harvard's Mihir Desai, who has observed an entire generation brought up on "over-promising the scope of change created by technology and the possibilities of business and finance", rather than "solving problems in new ways that sustainably deliver value to employees, capital providers and customers".

A consequence may be that they "nurse a grudge against capitalism, rather than understand the perverse world they were born into". But Desai ends with hope:

"Hopefully, a revitalization of that great American tradition of pragmatism will follow. Speculative assets without any economic function should be worth nothing. Existing institutions, flawed as they are, should be improved upon rather than being displaced. Risk and return are inevitably linked."

You can read Desai's full opinion piece here (~5 minute read).

2—Is there no escape?

Brink Lindsey conducted a thought experiment where despite "the concerted efforts of governments around the world to encourage couples to have more kids", birth rates continue to fall until "By the end of the 21st century... [the] world population has already been shrinking for decades":

"If a worker-hour of innovative activity yields less and less progress over time, and the total number of worker-hours is flat or declining, how can progress escape this squeeze?

...

I can see a couple of deus ex machina possibilities. The first is the development of anti-aging therapies that considerably extend the human life span. Widespread use of these therapies would reduce death rates, perhaps to the point that they fell below birth rates and the population started growing again. Furthermore, if people were living dramatically longer lives — let's say the prime-age working years, once 25-54, expanded to 25-84 or 25-114 (that is, they doubled or tripled) — the twenty-something years devoted to raising kids would now constitute a much smaller fraction of people's working lives. With this considerable drop in the relative cost of having children, we might expect a corresponding rise in the demand for kids and thus the fertility rate."

Lindsey goes through a few other ideas, before "entering the murky domain of population ethics", concluding that the answer to what's the right number of humans "in principle at least, is clear: the more, the merrier":

"With effectively limitless territory to spread out in and resources to use and consume, there's no necessary upper limit on the number of people capable of living full and fulfilling lives. But if the question is 'what's the right total number of people on this one planet?', things get much more complicated."

You can read Lindsey's full essay here (~12 minute read), in which he discusses everything from automation and artificial intelligence to finding the "missing Einsteins", concluding that we don't have to take the "the path of least resistance [that] leads to stagnation".

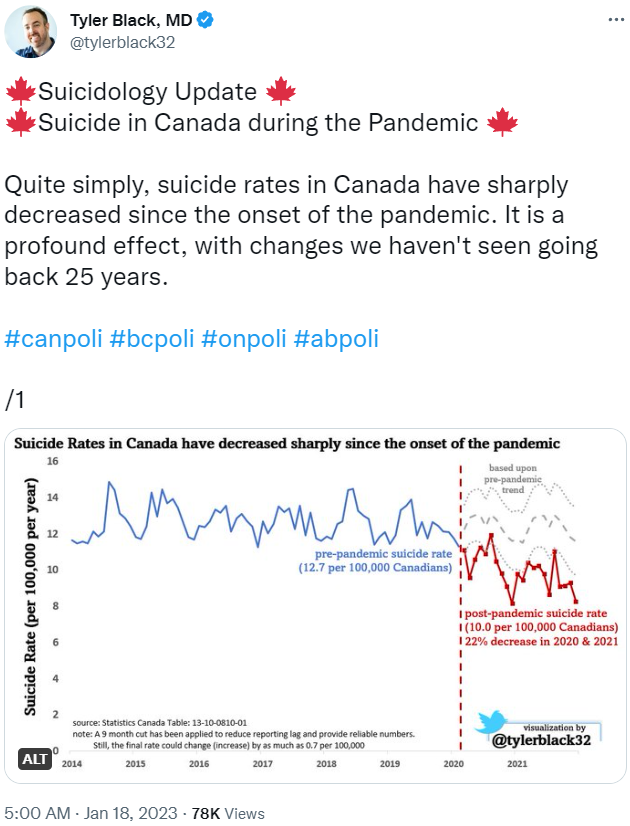

3—Suicidology

4—Concentrated benefits, dispersed costs

A relatively new paper titled The redistributive politics of monetary policy, by Louis Rouanet and Peter Hazlett, examined three past monetary policy events in an attempt to determine just how independent – i.e., protected from private and political influences – central banks really are. The three periods examined were:

- the 2007 financial crisis;

- the Fed's reaction to the COVID crisis; and

- the establishment and development of the euro.

According to the authors:

"When there are large benefits to being the first receiver, well-organized interest groups will form to capture those benefits. Additionally, when costs are dispersed and losers are unaware of the costs, they are less likely to advocate against the monetary policy. This seems to be the case for the Federal Reserve's policy after the 2007 financial crisis and during the current COVID crisis. However, when losers can identify the costs and others who are also losing, they will lobby for more beneficial policies, as evident from the ECB."

You can read the full paper here (~40 minute read), which predicts that the recent bout of inflation and inevitable central bank reforms might cause the influence of "key private interest groups such as the banking industry", to decline in favour of "the Treasury and its political overlords".

A change in influence from bankers to politicians would mean that future "inflation is more likely", as "the returns to seeking aid from the Fed increase".

5—Further reading...

🏗️ The Rise of Steel, Part 2.

💉 COVID-19 vaccines and sudden deaths: Separating fact from fiction.

❌ New Zealand's Prime Minister Jacinda Ardern resigned and called an election for October amidst unfavourable polling and record-low consumer confidence.

🤭 Tesla faked its 2016 self-driving demo "that essentially kicked off the entire industry-wide spending spree".

🤖 "OpenAI Used Kenyan Workers on Less Than $2 Per Hour to Make ChatGPT Less Toxic"

⌨️ Tech media site CNET "has been forced to issue multiple, major corrections" to posts created via ChatGPT, despite the articles supposedly being "reviewed, fact-checked and edited by real, human staff".