Mobilising Russia's economy

1—Mobilising Russia's economy

Russia's government officially ended its 'partial military mobilisation' at the start of this month. But it created to economic troubles that are only just beginning, leading "pressure to expand the country's economic mobilisation":

"On October 24, Putin signed a decree establishing a coordinating committee headed by prime minister Mikhail Mishustin. The committee is designed to ensure the provision of goods and services to support Russia’s military operations in Ukraine. This redoubled focus on economic intervention and management comes alongside the Russian Central Bank's marginally improved GDP forecast for 2022: it now anticipates a contraction of just 3−3.5% and 1−4% in 2023 as the economy 'hits bottom.' Are these figures credible indicators? Hardly. The pace of GDP decline on an annualized basis supposedly increased to 5% in September— and no one is sure when there might be another wave of mobilisation on the horizon. So what exactly is happening and what could economic mobilization actually achieve?"

That's from Nick Trickett, who reflects on the nation's rising business tax burden, collapsing consumption and revenues following the military mobilisation, a looming investment slowdown, and declines in the country's export capacity. You can read the full article here (~9 minute read).

2—Housing is folked up

Do otherwise well-informed people succumb to 'folk economic' thinking when it comes to housing? According to a new paper called Folk Economics and the Persistence of Political Opposition to New Housing, the answer is a resounding YES:

"Using two nationally representative surveys of urban and suburban residents, with embedded experiments, we show that about 30%-40% of Americans believe, contrary to basic economic theory and robust empirical evidence, that a large, exogenous increase in their region's housing stock would cause rents and home prices to rise.

...

Housing 'Supply Skepticism' is not just a manifestation of general economic ignorance. We show that the public understands the implications of supply and demand in markets for agricultural commodities, for labor, and even for cars, a durable consumer good that, like housing, trades in new and second-hand markets. There is also overwhelming agreement about how home prices and rents are locally affected by changes in neighborhood quality, by in-migration of rich people, by expansions of employment, by demolition of affordable homes, by new construction of expensive housing next door to more affordable homes, and (perhaps more questionably) by corporate ownership."

When asked who is to blame for high housing and rents, people tended to get it completely backwards – "developers got socked while environmentalists and anti-development activists went unscathed" – and "the staggering inequalities that mark the American housing landscape may have resulted, in part, from poorly-informed voters backing policies that foreclose the outcomes they prefer".

You can read the full paper by Clayton Nall, Christopher Elmendorf and Stan Oklobdzija on SSRN here (96 pages).

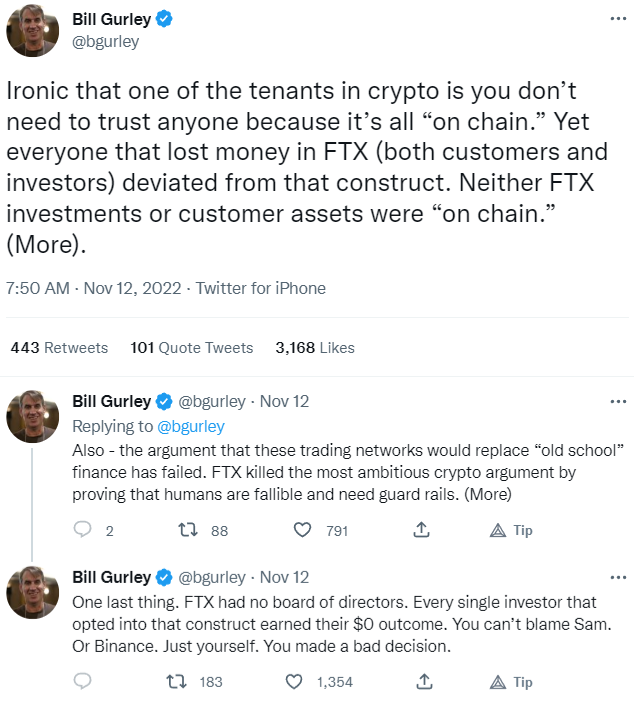

3—If you don't hold the keys...

4—Crashing back down to earth

The FT dug into the balance sheet of Sam Bankman-Fried's once high-flying crypto empire over the weekend, and the results were eye-watering:

"Sam Bankman-Fried's main international FTX exchange held just $900mn in easily sellable assets against $9bn of liabilities the day before it collapsed into bankruptcy, according to investment materials seen by the Financial Times.

...

A spreadsheet listing FTX international's assets and liabilities, seen by the Financial Times, point at the issues that brought Bankman-Fried crashing back down to earth. It references $5bn of withdrawals last Sunday, and a negative $8bn entry described as 'hidden, poorly internally labled '[email protected]' account'.

Bankman-Fried told the Financial Times the $8bn related to funds 'accidentally' extended to his trading firm, Alameda, but declined to comment further. Earlier this week, he tweeted that FTX international had $4bn in easily tradeable assets when it faced Sunday's $5bn surge of withdrawals."

Don't you just hate it when you 'accidentally' lend your own hedge fund $8 billion, especially when your own terms of service explicitly forbids the practice? Us too. But at least Alameda was making sound bets with FTX's clients' funds, right? Wrong:

"The company's biggest asset as of Thursday was $2.2bn worth of a cryptocurrency called Serum. Serum's total market value was $88mn on Saturday, according to data provider CryptoCompare, suggesting FTX's holdings would be worth far less if sold into the market."

It certainly appears that Bankman-Fried was, perhaps illegally, taking his clients' deposits from FTX and using them to speculate (poorly) on shitcoins like Serum via his trading firm Alameda. If so, the FTX crash wasn't a liquidity crisis, it was fraud done for the purpose of financing lifestyles, charity endeavours and to buy political influence to keep the whole Ponzi under wraps – according to Bloomberg, Bankman-Fried and his top lieutenant Ryan Salame "threw more money [$61.3 million] at Democrats this cycle than anyone but George Soros... [and Bankman-Fried said] he would spend up to $1 billion in the next presidential election".

You can read the FT's full analysis here (~4 minute read), which also found that "There are no bitcoin assets listed, despite bitcoin liabilities of $1.4bn".

5—Further reading...

⚠️ FTX is crypto's Enron: "John J. Ray III is now the Chief Executive Officer of FTX Trading Ltd. and a host of related entities, court papers show. Ray, a restructuring expert, oversaw the liquidation of Enron Corp. and weighty settlements that followed its accounting scandal."

🕵️♀️ Inside the Twitter meltdown, "a truly chaotic 24 hours at the company, and the mounting fears over what it means for the service that still serves as the heartbeat of the global news cycle".

📉 "Twitter senior secured bank loans- the top of the capital stack- at $0.60 implies that Twitter- for which @elonmusk paid $44 billion- is now worth less than $8 billion."