How China trapped itself

1—How China trapped itself

China has led global growth for over two decades. But policymakers now find themselves in "a hidden trap" of their own making, riddled with macroeconomic imbalances that are a result of the catch-up model it used to achieve that growth:

"Its high-investment development model was designed to resolve China's extraordinary investment deficiency, but nearly four decades later, it has left China with an excessively high investment rate. According to the World Bank, investment typically makes up around 25 percent of global GDP, ranging from 17 to 23 percent for more mature economies to 28 to 32 percent for developing economies in their high-growth stages. For a decade, however, China has invested an amount equal to 40 to 50 percent of its annual GDP every year."

That's from Michael Pettis, who has been warning of the imbalance for well over a decade. According to Pettis:

"It must reduce this unusually high level by a lot, but with growth so dependent on investment, it probably cannot do so without a sharp slowdown in overall economic activity."

Is that an outcome that policymakers, or Xi Jinping, are willing to tolerate? Already local governments, which have done very well out of the property investment boom, "have been eager, almost desperate, to revive the property market". But Pettis thinks the government will probably just swap one misallocation for another:

"More likely is that the Chinese government will compensate for the adverse impact of a slower and smaller property market, at least partly, by stepping up spending on infrastructure. Beijing already seems willing to follow this path and has told local governments that they must accelerate or increase their infrastructure spending plans, or both.

But building more bridges and high-speed railway systems still means allowing growth to be driven mainly by nonproductive investment, as it has been during the past decade. This will cause China's debt burden to continue to rise and resources to be misallocated until the economy can no longer sustain the consequences. When that has happened in previous cases, the result has usually been a very disruptive adjustment, often in the form of a financial crisis akin to Brazil's in the early 1980s."

You can read Pettis' full article here (~8 minute read), which concludes that another, more sustainable outcome – rebalancing away from state-directed investment towards household consumption – "is extremely difficult to accomplish politically", because of the "distribution of political power in China".

2—Liz Truss' history lesson

It only took a week but it's now clear that Liz Truss is no Margaret Thatcher. So writes Oliver Hartwich, who starts with a flashback to 1981:

"The British prime minister received an unflattering open letter. Its signatories were 364 economists, all united in condemning her economic management.

'We believe that a large number of economists in British universities, whatever their politics, think the Government's present economic policies to be wrong and for that, for the sake of the country – and the profession – it is time we all spoke up,' the letter stated.

The prime minister ignored it. And rightly so. Because as history showed, Margaret Thatcher eventually restored fiscal and monetary discipline with the enormous tax increases in her 1981 budget."

The Thatcher budget was a painful dose of fiscal discipline, "increasing taxes by £4 billion, the equivalent of about 2 percent of GDP". Truss' mini budget – at least what was initially proposed – tried to do precisely the opposite:

"Today, as then, British public finances are in disarray, inflation and interest rates are on the rise, and the economy is stuttering. But instead of increasing taxes by 2 percent of GDP, Truss plans to cut taxes by the same amount.

What is dressed up by Truss as a Thatcherite supply-side reform is instead an uber-Keynesian stimulus."

Hartwich admires the "ambition" of Truss and her chancellor, Kwasi Kwarteng, to break the 16-year economic rot and "lift growth, remove supply constraints and liberalise the British economy". But "they should have studied her example more closely", especially how Thatcher – "at least in her early years as PM – listened to her economic advisors and was keen not to spook financial markets".

You can find Hartwich's full article in Newsroom here (~4 minute read).

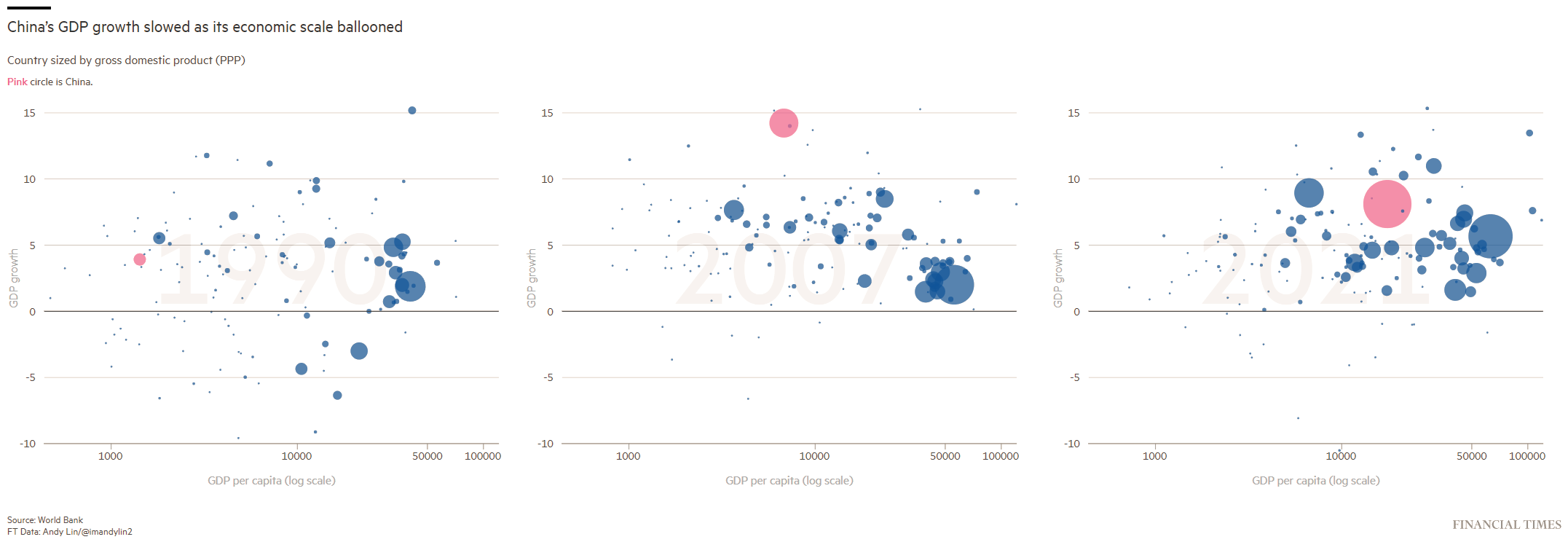

3—China's slowing growth

4—Remote work and housing demand

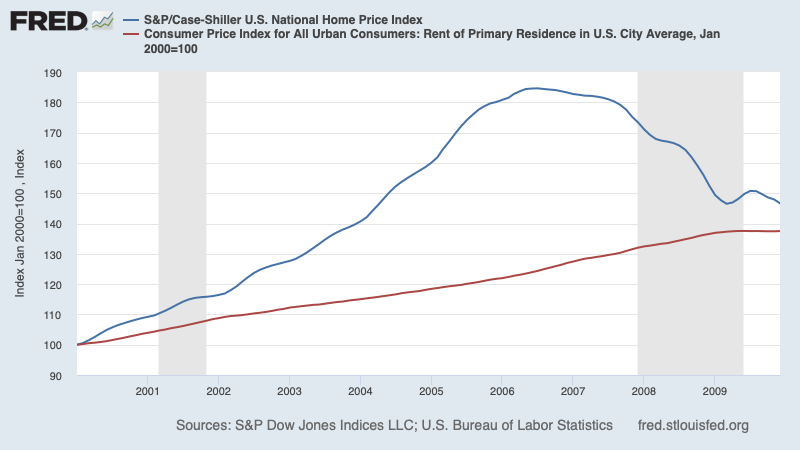

House prices have risen across the developed world. In the US the average house price jumped "more than 40 percent from February 2020 to June 2022". That led some to issue warnings about another housing bubble:

"At first glance, the pandemic housing price surge may seem reminiscent of the 2000s bubble. But this time really is different, in a couple of ways.

What happened from 2000 to 2006 looked, even at the time, like pure speculative fever rather than a response to a real surge in housing demand. How could you tell? By the fact that the surge in home prices wasn’t matched by a surge in rents:

This time, however, rents have soared along with home prices."

That's from Paul Krugman writing in the NYT, who points out that unlike during the 2000-06 bubble where price rises were mostly concentrated in the NIMBY (hard to build) cities, this time "prices have soared everywhere".

But why? Krugman continues:

"The most likely explanation is that this time there was, indeed, a big rise in the underlying demand for housing, not just speculation, and that this rise took place too fast for housing construction to keep up, even in places where building isn’t overly restricted. (Supply-chain problems for construction materials didn’t help, either.)

So what happened? Like many people, I’ve speculated that the pandemic-induced rise in remote work led to a demand for more space at home. New research from economists at the San Francisco Fed supports this view. They found that remote work expanded most in locations where it was already relatively common and that home prices rose the most in these locations. (“Migration controls” refers to the Fed’s attempt to measure this relationship with and without the separate, though not unrelated, movement of workers from place to place.)"

You can read Krugman's full post here (~4 minute read), which concludes that the pandemic probably "brought forward changes that were going to happen eventually".

The good news is that some of today's inflation may simply reflect "a one-time shift in people's housing preferences", while the bad news is that "America's housing affordability crisis has gotten even worse", especially in places such as California and New York where "NIMBYism... will do even more damage in the remote-work era".

5—Further reading...

⛈️ "Sydney is on track to set a new record for its wettest ever year, with more than two months still to go, as the city braces for another 100mm of rain over the next few days."

🌲 "Chief executive officers are putting a number of ESG [environmental, social, and corporate governance] goals on hold as they try to prepare their businesses for the fallout from a possible recession, according to a study conducted by KPMG."

🔓 US President Joe Biden pardoned all federal offenders convicted of "simple marijuana possession", and "instructed Secretary of Health and Human Services Xavier Becerra and Attorney General Merrick Garland to begin reviewing how marijuana is classified under federal drug laws".

🙊 The UN human rights council rejected a debate on the alleged human rights abuses in China's Xinjiang region. 19 countries voted against the move following comments from Chinese officials that it would establish a "dangerous shortcut" for examining other countries' human rights records.