An infinite appetite for risk

1—An infinite appetite for risk

Sam Bankman-Fried (SBF) was well-know as a utilitarian who believed in effective altruism:

"A self-disciplined, vegan workaholic, Bankman-Fried is a 'Benthamite' committed to the moral theory of utilitarianism: the promotion of the greatest good for the greatest number of people."

But should utilitarians "have an infinite appetite for risk, eg the St. Petersburg paradox", as it appears SBF did? So asks Scott Alexander:

"I think a first good answer would be something like 'you shouldn't even consider this question unless you are following the deontological rules and avoiding unethical externalities, which seems really hard to do as the amount that you're risking gets higher'. But two specific points beyond that.

First, it's true that $20K buys twice as many bed nets as $10K. But most of what FTX was funding wasn't bed nets - it was things like medical research, or lobbying, or AI research labs. The effectiveness of these things probably follows a power law distribution - your first dollar funds an amazing lobbying organization run by superstars, your hundred millionth dollar funds a so-so lobbying organization scraping the bottom of the barrel, and your ten billionth dollar funds a hobo with the word 'LABIYIST' scrawled on his shirt.

...

Second, if you St. Petersburg yourself a bunch of times and lose everything, it's going to be really hard to pat yourself on the back for a job counterfactually well done and walk away. More likely you're going to panic and start grasping for unethical schemes that let you escape doom. So real-world St. Petersburg isn't '50% chance of doubling your money, 50% chance of zero', it's '50% chance of doubling your money, 50% chance of getting put in a psychologically toxic situation where you'll face almost irresistible pressure to do crazy things that will have vast negative impact'."

There's plenty more in Alexander's full thoughts here (~9 minute read), including how it appears that SBF had managed to influence/buy off Congress, along with "the leading US investigative reporting group". The securities regulator was even "in the process of allying with SBF to anoint him as the face of legitimate well-regulated crypto in America"!

2—The crypto bubble

How does the bursting of the crypto bubble compare to events in the past? Eric Talley claimed that it's "at least the 4th significant burst 'asset bubble' of my adult life", and each have had similarities:

"First: In each an emergent 'cool-kids’ view' challenged traditional thinking abt how markets work. Whether it's trading platforms, non-brick-and-mortar marketing, copula-based securitizations or DeFi, vocal skeptics were seen as 'get-off-my-lawn' dinosaurs who just didn't get it.

Second: Proponents of each new narrative were themselves genuine believers who drank the Kool-Aid; bona fide proselytizers speaking the truth (or *their* version of it) in touting the narrative. Many were also smart and dynamic, and they easily attracted uncritical groupies

Third: As the 'new narrative' bubble persisted over months/years, even skeptics began questioning whether they were too hasty to criticize; maybe(?) a radically new paradigm *was* emerging. Many dampened their criticisms. The resulting equilibrium was uneasy/wary acceptance..."

You can read Talley's full ten-point list here (~3 minute read), which warns that we humans are doomed to repeat the cycle – "like a cicada, a next 'new thing' will pop up within a decade".

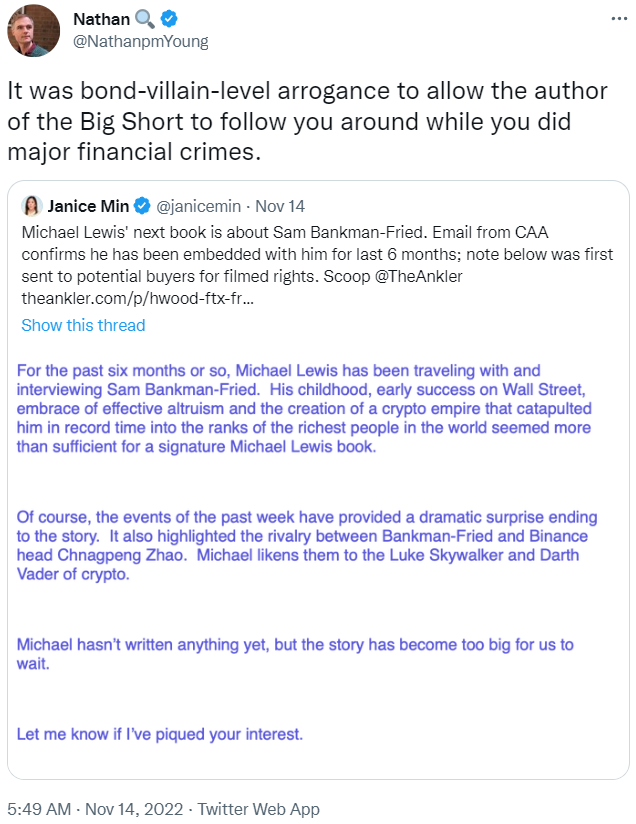

3—Bond villain arrogance

4—Shedding labour

Using a bottom-up framework – as opposed to a top-down model that assumes "the Fed has a dial, like the temperature control on an oven" – economist Arnold Kling makes some predictions about "which patterns of trade might break up soon":

"One possibility I foresee is a decline in hiring in the non-profit sector, which employs about 10 percent of American workers. The loss of stock market wealth is likely to cause a drop in contributions to nonprofits as well as a decline in the value of endowments.

The construction industry will shrink some, because of higher interest rates. And we have seen some major tech firms announce layoffs in order to trim expenses. The job openings in retail businesses might absorb some of the workers from other industries, but I doubt that the college graduating class of '23 who are hoping for jobs in the non-profit sector will want to work for Chick-Fil-A. So I think we will see some modest declines in the net increases in employment."

You can read Kling's full essay here (~4 minute read), in which he lays out the thinking behind his framework, including that productivity might fall in periods of low unemployment because firms start hoarding people "who are not very productive at the margin", because finding anyone is difficult.

5—Further reading...

👩💻 The tech crunch keeps biting: "Amazon is planning to lay off some 10,000 employees in corporate and technology jobs (~3% of the total), the New York Times reported on Monday, citing anonymous sources with knowledge of the matter."

🥔 "Russia's regions lack money to pay mobilised soldiers, leading to the mobilised and their families being paid with potatoes, fish, coal, firewood, deer carcasses or not getting any payment at all."

😷 "Investors have welcomed the combined 36 steps [Chinese] policymakers are taking to revive growth. But much remains uncertain, not least how officials will react to widespread covid outbreaks next year. It may be that China cannot truly revive home sales until it takes further steps to live with the disease. If that is the case, the 20 steps on covid may be just as important a signal to the housing market as the 16 steps on property."

👨👩👧👦 "The global population is projected to reach 8 billion on 15 November 2022, and India is projected to surpass China as the world's most populous country in 2023, according to World Population Prospects 2022, released today on World Population Day."