A great modern socialist country

1—A great modern socialist country

An abbreviated version of the Report to the 20th National Congress of the Communist Party of China was released earlier this week, which according to China watcher Bill Bishop was "a mixture of triumphalism, aspiration, a sense of besiegement and global ambition":

"The triumph is the long list of what they have accomplished so far, the aspiration is Chinese modernisation and the rejuvenation of the Chinese nation, the sense besiegement can be seen in language like 'external attempts to blackmail, contain, blockade, and exert maximum pressure on China' among other things, and the global ambition can be seen in statements like 'we will continue to work hard and build China into a great modern socialist country that leads the world in terms of composite national strength and international influence by the middle of the century.'"

Bishop notes that the report effectively signals that "the general direction of travel of economic policies over the last several years looks unlikely to change materially".

Those policies are Xi Jinping's, who has been in power for a decade. How have they worked out? According to Noah Smith, the verdict isn't great:

"Already, the mistakes have begun piling up. Growth, especially all-important productivity growth, slowed a lot even before Covid and has now basically halted. The crash is due largely to Xi Jinping's personal choices — his stubborn insistence on Zero Covid (which also has a dimension of social control), his willingness to let the vast real estate sector crash, and his crackdown on tech companies and other entrepreneurs. Overseas, Xi's signature Belt and Road project has left a trail of uneconomical infrastructure, debt, and bad feelings around the world. His aggressive 'wolf warrior' diplomacy, combined with his crackdown on Hong Kong and his use of concentration camps and totalitarian surveillance in Xinjiang, has soured much of the world on the prospect of Chinese leadership. And his promise of a 'no limits' partnership with Russia blew up in his face when Putin bungled the invasion of Ukraine. Even Xi’s nationalized industrial policy — the Made in China 2025 initiative and the more recent push for semiconductor dominance — has not done much to accelerate growth, and has prompted the U.S. and other countries to switch from engagement to outright economic warfare."

Under Xi Jinping – "a nostalgic Baby Boomer kicking against modernity and yearning for a semi-imagined past greatness" – China is no longer "full of hope and energy", and for the next decade or so the Chinese people will likely "find themselves stuck with a leader who looked like a Great Man of History but whom they are belatedly realising is not all he was cracked up to be".

You can read Bill Bishop's summary of the 20th Party Congress here (~4 minute read), and Noah Smith's piece on Xi Jinping here (~6 minute read).

2—Against gradualism

Global central banks, led by the US Fed, blundered badly in 2020-21 by misreading inflation as "transitory". But in 2022 they followed that up with another mistake – gradualism:

"While inflation was accelerating in early 2022, the Fed was content to let short-term rates stay near zero. All the Fed did was move from 'not even thinking about raising rates' to 'thinking about raising rates'. Many Fed watchers wrongly thought that this represented tightening. In mid-March, they raised rates by a measly quarter point, far too little to slow the relentless rise in core inflation. Policy was still expansionary. And yet many pundits thought the Fed was overreacting, moving too aggressively."

Economist Scott Sumner reckons that we're "about to pay the price for the Fed's gradualism":

"By not tightening aggressively at the end of 2021, the Fed let inflation get much more deeply entrenched in the economy. With even core inflation now rising, the pain associated with bringing it down will be much greater. A small recession in 2022 would have been better than a bigger one in 2023."

You can read Sumner's full article here (~2 minute read), which argues that "The Fed needs to stop worrying about scaring markets and focus on their core responsibilities."

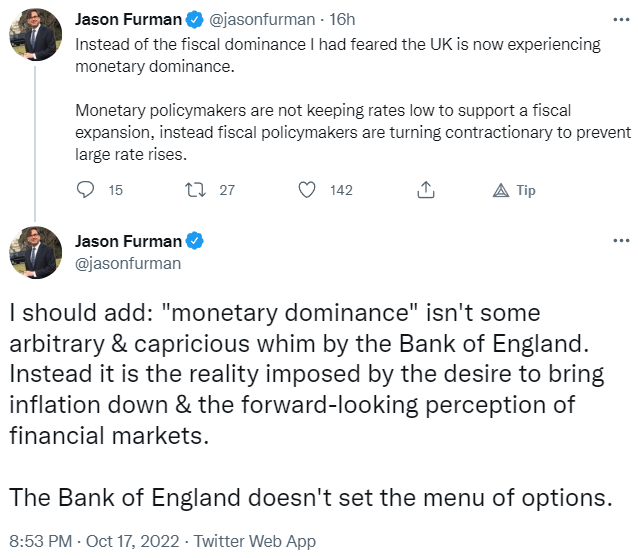

3—Monetary dominance

4—Baffling claims about AI

Can AI replace radiologists? Is augmenting human workers the same as replacing them? Is there a viable competitor for human general intelligence in the AI world?

Despite some prominent figures in the AI space recently suggesting that the answer to all three might be yes, it's in fact a resounding no. Take augmentation:

"Augmentation is way easier, because you don’t have to solve the whole job. A calculator augments an accountant; it doesn’t figure out what is deductible or where there might be a loophole in a tax code. We know how to build machines that do math (augmentation); we don't know how to build machines that can read tax codes (replacement)."

Or radiology:

"Just because AI can solve some aspects of radiology doesn't mean by any stretch of the imagination that they can solve all aspects; Jeopardy isn't oncology, and scanning an image is not reading clinical notes. There is no evidence whatsoever that what has gotten us, sort of, into the game of reading scans is going to bring us all the way into the promised land of a radiologist in an app any time soon. As Matthew Fenech, Co-founder and Chief Medical Officer @una_health put this morning, 'to argue for radiologist replacement in anything less than the medium term is to fundamentally misunderstand their role.'"

That's all from a new post by Gary Marcus which you can check out here (~7 minute read). Marcus likens the act of scientists' hedging their claims with probably to "me saying Serena Williams could probably beat me in tennis".

5—Further reading...

😷 "More than ten percent of Americans with recent work experience say they will continue social distancing after the COVID-19 pandemic ends, and another 45 percent will do so in limited ways."

💸 Nigerians are poorer today than they were a decade despite "huge reserves of oil, gas and other minerals, plenty of fertile land and a young population of go-getters... because of rotten politics and bad governance." The government spends more subsidising petrol than on health, education and welfare combined.

🗳️ Why US Republicans probably won't do as poorly in the mid-terms as the latest polls suggest.

👎 Public sentiment in Russia has turned against Putin, with the dictator's recent threats to use nuclear weapons "feeding public uncertainty and doubt about the soundness of Kremlin strategy".